Making great businesses better

Our portfolio spans 160+ countries and a variety of sectors. Blending the combined knowledge of our 110+ companies significantly boosts their growth.

Search

Filter by

SMD

Subsea vehicle systems

In April 2008, Inflexion backed subsea vehicle maker SMD. Seven years later, Hong Kong-listed Zhuzhou CSR Times Electric Company Limited purchased the business.

View case study

Ster Century

Cinema operator

In 2003, Inflexion backed cinema operator Ster Century. A short but successful stewardship saw profits grow by 37% before being sold to a financial buyer in 2004.

View case study

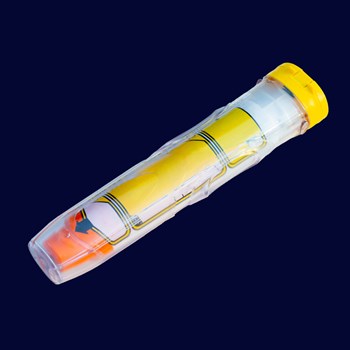

SteriPack

Medical device contract designer and manufacturer

SteriPack is a leading global contract manufacturer serving the medical device, pharmaceutical and diagnostic markets. Inflexion led the buyout of SteriPack in 2022.

View case study

Succession

Wealth management

Succession is the UK’s largest independent wealth manager. Inflexion backed the buyout of Succession in 2014 before selling its investment to FTSE 100 business Aviva plc for £385 million in 2022.

View case study

Tekton

Software for the construction industry

Inflexion led the £12m buyout of construction software business Tekton in 2006, going on to support organic and acquisitive growth before being bought by Sage (UK) in 2008.

View case study

Times Higher Education

Higher education rankings and data provider

Times Higher Education is the world leader in university data, rankings and content and the company behind the definitive annual THE World University Rankings. Inflexion backed the buyout of Times Higher Education in 2019.

View case study

UK Power Reserve

Flexible power generation

UK Power Reserve partnered with Inflexion in 2015. Over the following 2.5 years, revenues quadrupled to c£80m, attracting Singaporean trade buyer Sembcorp in 2018.

View case study

Viking Moorings

Mooring equipment supplier

In 2006 Inflexion led the £22m buyout of moorings equipment supplier Viking Moorings. In 2009 HSBC Private Equity bought the business, generating a 10.2x return on investment.

View case study

Vivona Brands

Brand creation and management

Inflexion led the buyout of brand creation and management company Vivona in 2012, merging the US partner into the business and allowing for succession as part of the deal.

View case study

Xtrac

Specialist engineering manufacturer

In 2017 Inflexion backed the buyout of Xtrac, a market-leading manufacturer of transmissions systems for the motorsport and high-performance automotive sectors. In 2023 Inflexion sold its investment to MiddleGround Capital.

View case study