Aligning pricing to value

Pricing is arguably the single most effective tool in the Chief Commercial Officer’s armoury for value creation, but getting it right requires careful thought and structure, according to Mark Billige, CEO of Simon-Kucher & Partners who spoke at Inflexion’s Commercial Exchange.

Mark cites a regular survey run by Simon-Kucher to understand the thinking of industry professionals: “If you ask firms about their typical value creation focus, volume growth comes top of their list and pricing comes a distant third” he says, with nearly 80% of respondents citing volume growth, and just 17% mentioning pricing (operations improvement/cost reduction is a close second at 61%).

Mark describes this thinking as ‘inverted’: perhaps because pricing is deemed risky, but more importantly because a 5% improvement to price directly leads to a greater impact on bottom line, than either improving either volume, or cost by the same amount”.

He continues to explain the ‘pricing excellence’ multiplier effect, improving the value of businesses that have successfully transformed their underlying business model through pricing, for example for those transitioning from a per-transaction to subscription-based pricing. He outlines a three-pronged approach for how to think about pricing in your organisation:

#1 Carefully plan your regular pricing campaigns

With the cost-of-living crisis well documented, ensuring at the very least your organisational costs are covered is essential for protecting margins. Getting this process right is a challenge that requires careful research and planning to succeed. Mark points to further survey work which indicates that on average companies only achieve a third of the increase they were seeking in a typical campaign.

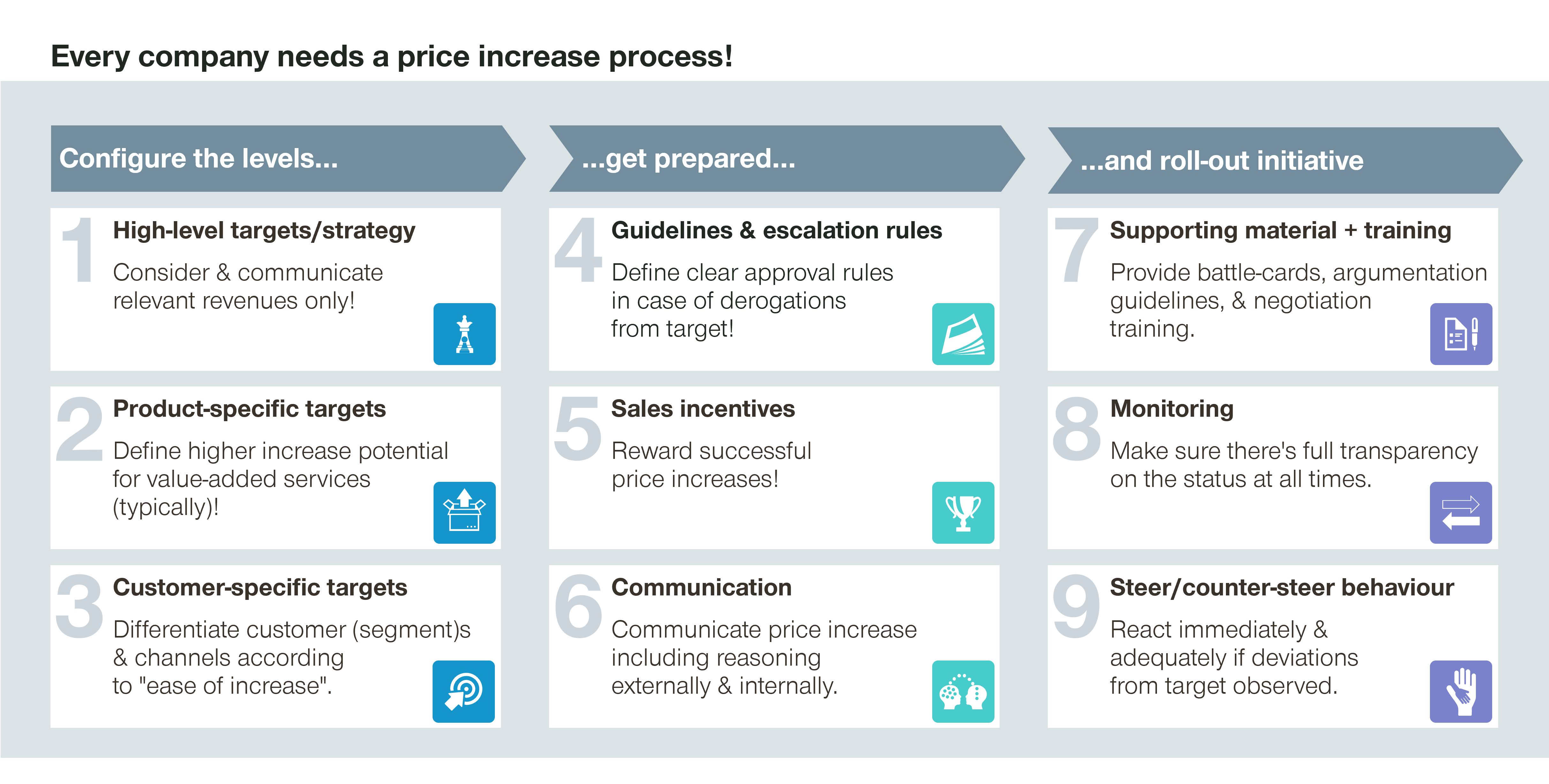

Mark’s solution is simple:

“Don’t outsource the process to sales and think carefully about configuring the right levels”: both in terms of any contractual restrictions, as well as where pricing may not be aligned with product value.

Secondly, “be well prepared”: for example having clear guidance and escalation rules for when the customer pushes back; reward successful increases and communicate a clear rationale both internally as well as externally

Finally: “execute”: prepare, train and arm the sales team to have challenging conversations, carefully track progress and be prepared to respond

Zlatko Vucetic, CEO of Nordics-based software business, Infront, which joined the Inflexion portfolio in 2021 agrees “this methodology has helped us properly plan out our approach to pricing and for the first time we had a methodological and structural process across our European markets, working in tandem with the sales team”

Source: Simon-Kucher & Partners

#2 Structured discount management programs

Mark’s second theme focuses on thinking about controlling discounts. “Your sales team maybe relying on gut feel when it comes to each negotiation or new contract sale, which can typically mean that end pricing for a given customer can vary greatly”.

Mark cites the need to shift from “unstructured discounting to a structured reward mechanism” ensuring any flexibility in the pricing offered by the sales team has structure applied. There are lots of ways to do this – so discount models employed may be based on the customer tier within the organisation, specific discounts that relate as a ‘one-off’ for the specific proposal, or rebate type mechanisms that are performance-based on the customers activity with you.

Andy Boland, CFO of Digital Wholesale Solutions (DWS) agrees “we’ve been working to enable a series of tiered discounting levels, which scale with the size and number of products selected by the customer”

Of course, as with all pricing initiatives - careful monitoring is key, and there are a number of sophisticated tool-based solutions that enable sales team members to see how the level of discount currently being offered for a given deal compares to equivalent deals completed by their peers.

#3 Revenue model engineering

The final element, and perhaps most valuable of all, involves evolving the structure of your pricing model. The process typically involves thinking across two dimensions:

Firstly, about how you balance the risk and reward between buyer and seller. At one end of the extreme are variable or Pay-As-You-Go models, where the user pays incrementally the more they use the good or service; at the other end are fixed or flat rate models which enable “all you can eat” by the purchaser.

“Ultimately, creativity comes between the two extremes and thinking about the type of behaviour you want to influence”, balancing between being able to give the customer certainty, or at the very least predictability over cost, whilst also sharing in the value they derive from using the product.

The second dimension is about how you move towards ‘value-based’ pricing. Pricing close to inputs, or at the individual product level enables easy comparability with your competitors, and/or enables customers to understand your costs and margins; whereas pricing on value or the outcome achieved is far harder to achieve, or to compare.

Contact