Backing the most ambitious teams across Europe.

Our Buyout Fund makes majority investments in European high-growth, entrepreneurial businesses, led by ambitious management teams. In 2022, we closed Buyout Fund VI at €3bn, allowing us to invest in companies across Europe with enterprise values typically up to €1bn.

€

3

bn

current fund size

6

th

vintage fund

Majority

equity stakes

Buyout in action

Businesses we’ve partnered with

The team is made up of very smart individuals, common to most private equity firms but Inflexion empowers its people to make decisions. They are fun to work with and bring a strong sense of energy and drive. They have a strong culture of collaboration.

Adrian Thompson

CEO, Aspen PumpsOur Buyout Funds are the foundation of Inflexion’s long and fruitful history. While we remain firmly focused on high-potential, mid-market businesses, we also strive to remain agile. Today, our size enables us to write larger cheques supporting a wider array of growing companies.

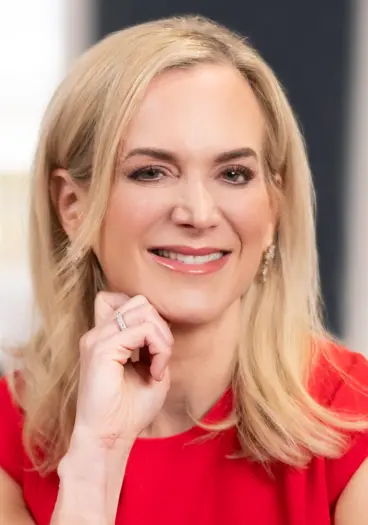

Flor Kassai

Partner and Head of Buyout Fund, Inflexion

CASE STUDY

Creating a global financial data software provider

Discover how Inflexion delisted Infront from the Oslo Stock Exchange, and have since supported the business with talent, technology, commercial strategies and M&A, to achieve European success.

Find out moreContact us

Please contact us if you would like to learn more about our Buyout Fund.